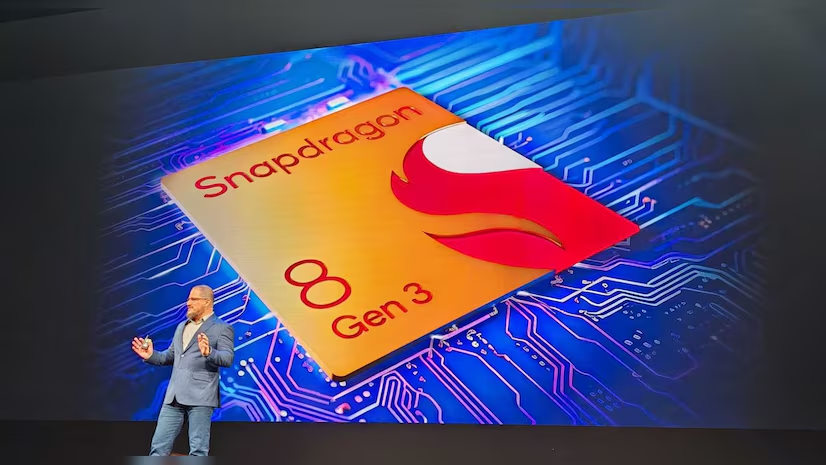

Qualcomm optimistic on Trump era, expects chip sales growth ahead

Qualcomm’s technology licensing business manager, Alex Rogers, told an analyst that the San Diego, California, corporation had a “fantastic connection” with Trump’s previous government, which thwarted Broadcom’s hostile takeover offer.

“We anticipate a good connection.”We are hopeful about Trump’s Commerce Secretary candidate, Howard Lutnick, so we expect a healthy relationship and to be active as in this administration,” Rogers said.

Trump has suggested 60% taxes on Chinese imports, which experts say China may counter with levies on American goods.

Qualcomm Confident Despite Trade Tensions, Diversifies to Offset Losses

“As geopolitics started to become front and center in the US-China discourse, Qualcomm collaborations with China actually rose, as we extended to other industries” outside smartphones, Amon added.

The company has diversified by supplying chips for vehicle dashboards and driver-assistance systems to General Motors and working with Microsoft and PC makers to compete with Intel and Advanced Micro Devices in the laptop market.

Qualcomm also faces long-term decline from Apple, which is developing wireless modem processors. Qualcomm’s finance head and COO, Akash Palkhiwala, claimed the new categories will offset sales losses.

Qualcomm anticipates $8 billion in automotive chip sales and $4 billion from PCs by fiscal 2029. It expects $2 billion from Qualcomm-equipped augmented and mixed-reality headsets like Meta Platforms’.

The company expects $4 billion in industrial chips that connect factory machines to networks and $4 billion in IoT chips for wireless headphones and smart home devices like cameras.

The company’s fiscal 2024 IoT sales fell to $5.4 billion, below its 2021 investor day projection of $9 billion.

Qualcomm shares have up 13.7% this year, compared to the Nasdaq Composite’s 25%.

Smartphones dominate its business.